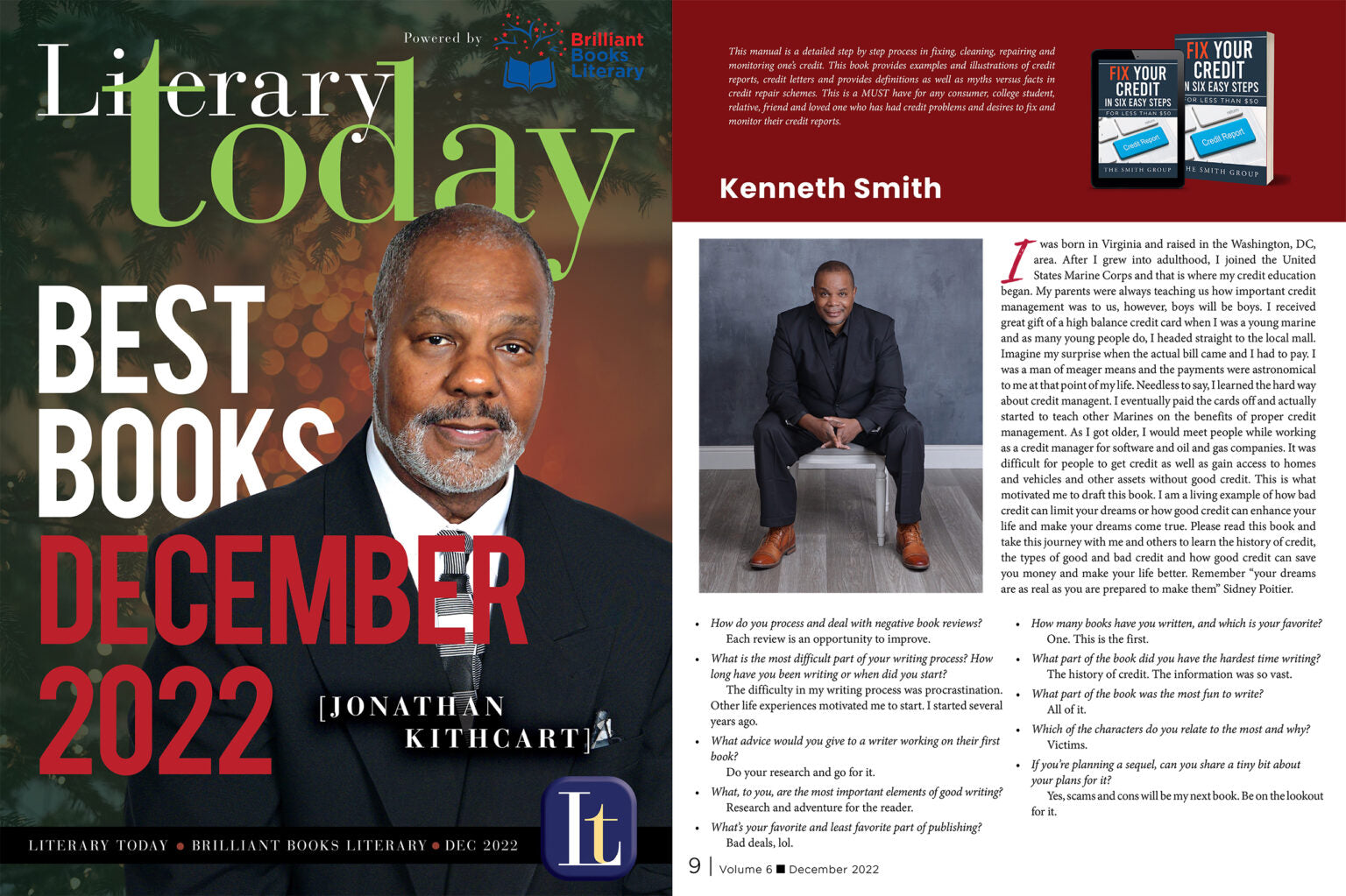

Kenneth Smith

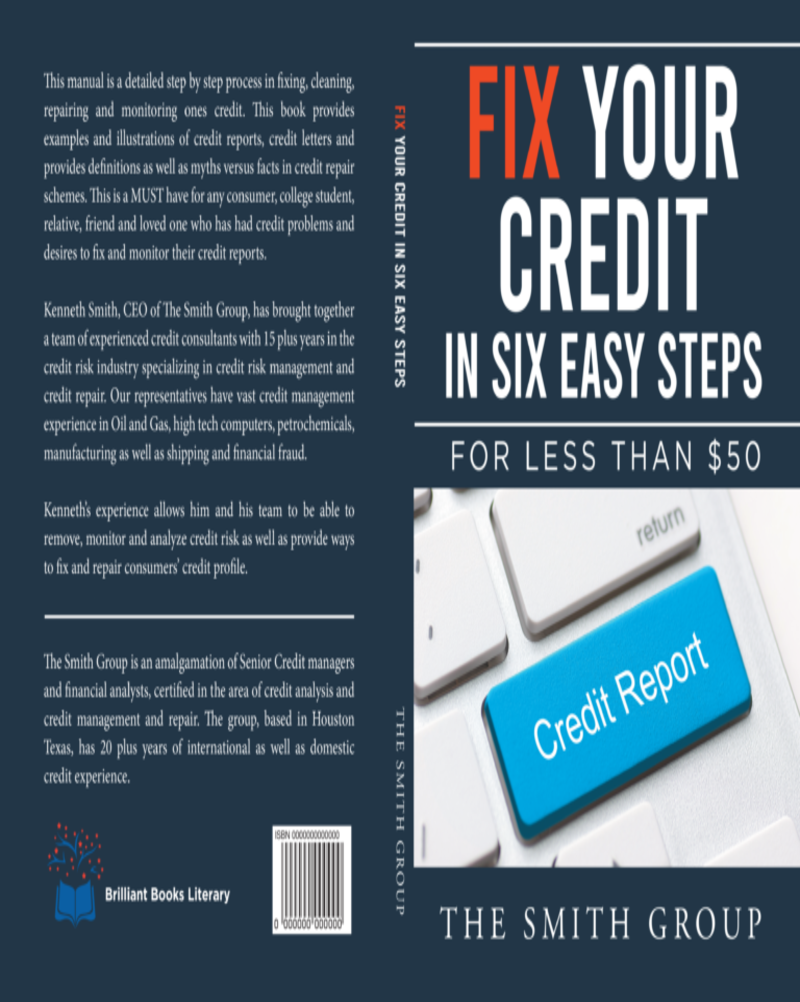

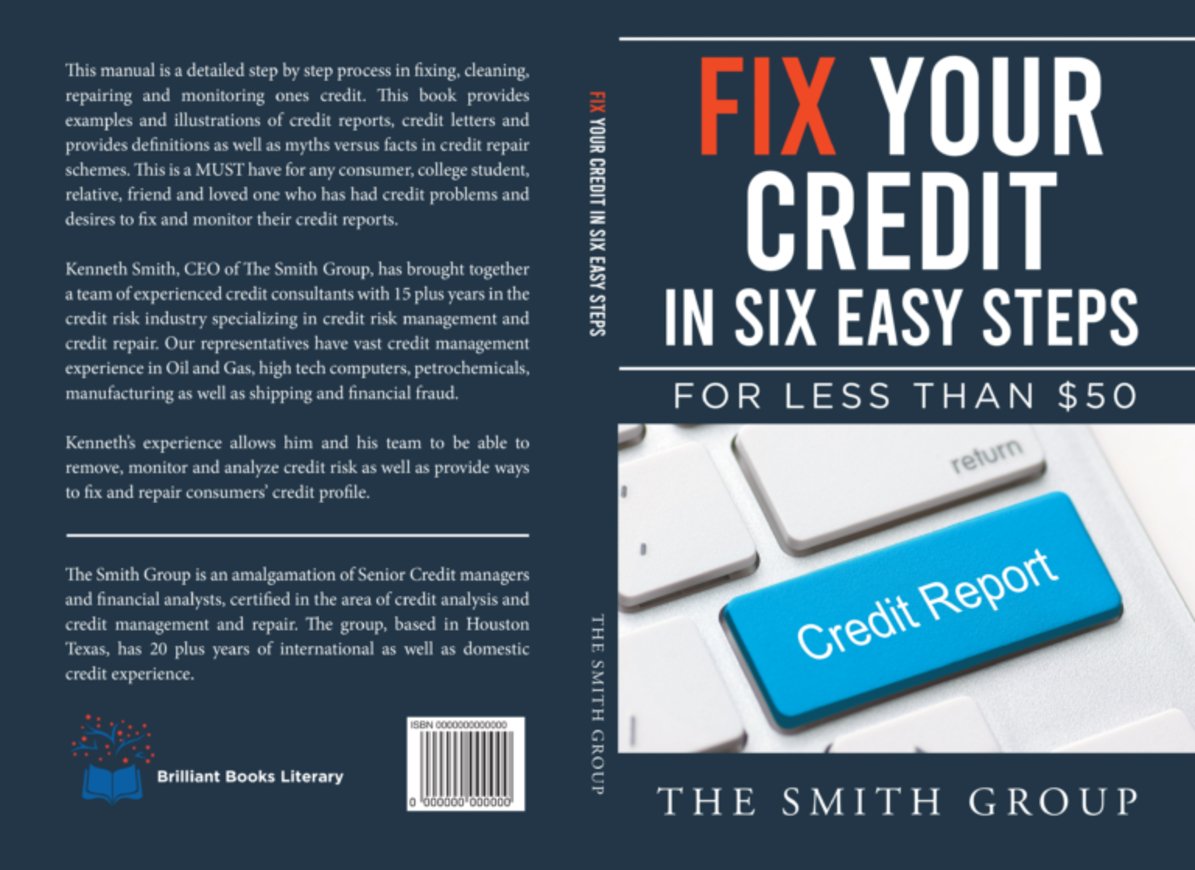

Fix Your Credit in Six Easy Steps: For Less Than $50

Share

About The Author

Kenneth Smith, CEO of The Smith Group, has brought together a team of experienced credit consultants with 15 plus years in the credit risk industry specializing in credit risk management and credit repair. Our representatives have vast credit management experience in Oil and Gas, high tech computers, petrochemicals, manufacturing as well as shipping and financial fraud.

The Smith Group is an amalgamation of Senior Credit managers and financial analysts, certified in the area of credit analysis and credit management and repair. The group, based in Houston Texas, has 20 plus years of international as well as domestic credit experience.

About This Book

The purpose of this book is to help anyone who has a negative impact on their credit report. Many people have negative credit status and this prohibits consumers from achieving the things vital to the pursuit of happiness. This book is for anyone who is thinking about fixing and maintaining his or her credit status. This manual is for people like me, who have problems in life such as life itself. No one person is immune to bad things happening to them. No one is immune to bad things such as bad timing of financial and emotional events in your life or just plain bad luck as we call it. Things happen that are beyond our control and sometimes beyond the realm of understanding. This book can and will show you how bad luck, bad timing and bad decisions do not have to leave you in a negative situation. This book is designed for people such as mothers, fathers, students, teachers, hairstylists, military personnel, single parents, divorced, married, separated, low income, high income, slow learners (like myself) and shop-a-holics.

Testimonials

-

” This manual was instrumental in me getting old items off my report, thereby raising my credit score. I highly recommend this book. “– L. Hubbard

-

” Going through the process this book teaches me to clean out negative items from my previous marriage. Very good read. “– J. Barnes

-

” I tried to raise my score by paying off old items that didn’t belong to me but read this book and found the easy way to facilitate that process. “– J. Weaver

-

” The education on the history of credit was enough to teach my kids the importance of maintaining a great credit score. I am very pleased with the knowledge gained. “– Debbie P.

Literary Today Magazine